Private and public sector debt to skyrocket amid pandemic

Categories :

Private and public sector debt to skyrocket amid pandemic, says GlobalData

News Release provided by Global Data

The global debt level is expected to surge significantly in the first half of 2020 due to uncertain financial conditions and the reduction of the central bank’s policy rate around the world amid the COVD-19 pandemic, says GlobalData, a leading data and analytics company.

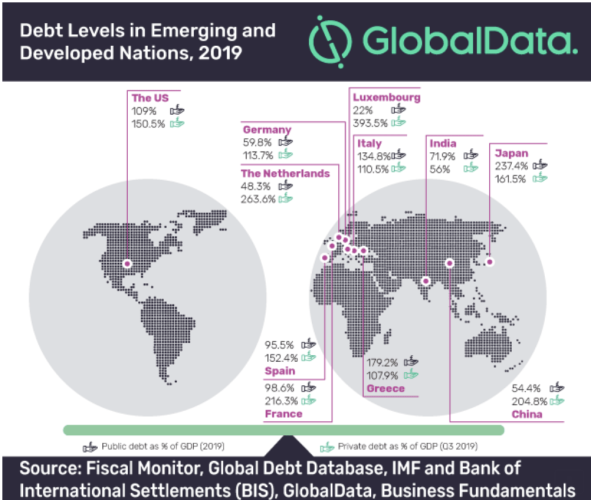

With an increase in debt burden of both developed and emerging economies, the global debt level accounted for more than twice of the global GDP. Stimulus packages and cheaper loans for small businesses are expected to elevate both government and private sector debts. Countries that will be majorly affected by the COVID-19 outbreak are those that had a high level of public debt in 2019 such as Japan (237.4% of GDP), the US (108.9%), Italy (134.7%) and Greece (179.2%). In the first three quarters of 2019, 30 of the 43 nations that have made their data available have private debt of more than 100% of the GDP with Luxembourg having the highest at 393.5%.

Shalin Vora, Economic Research Analyst at GlobalData says: “A rise in unplanned government expenditure in the form of high stimulus packages will widen the budget deficit and governments will have to curtail productive investments as additional amount is spent on paying off the interest on the debt. On the other hand, excessive private debt, especially during the pandemic, may increase the inability to pay off the loans and lead to a rise in defaults due to higher unemployment and lower wages.”

China, which already has high private debts, was the epicenter of the pandemic outbreak. Many advanced economies hard-hit by the COVID19 outbreak have a very high level of private debt, which has contributed significantly to the rise in global debt over the last decade. Such countries include Italy (110.5%), Spain (152.4%), France (216.3%) and the US (150.5%).

Governments in these nations were compelled to adopt very high stimulus packages to minimize the damage and revive the economy. China called out a stimulus package worth 2.58% of its GDP whereas Italy, Spain, France and the US allocated 43.38%, 15.82%, 16.82% and 20.99% of their GDPs, respectively, which also includes the provision of support to struggling businesses in the form of cheap loans. These would further trigger private debt to surge. On the other hand, governments may increase taxes to compensate for the higher debt burden they face today, ultimately reducing investor confidence in the economies.

Most of the developed nations with high debt burdens are expected to be in recession in 2020 due to the economic freeze. With lower economic productivity, government’s income (taxes) will decrease along with a sharp rise in expenditure (stimulus package) which is expected to increase the chances of the country getting into the debt trap.

Vora concludes: “Governments must implement forward-looking policies to avoid falling into a debt trap. Stimulus measures are required to support the struggling economy; however, governments must implement cautionary approaches to stabilize the economy and avoid a debt crisis. Domestic markets need to be boosted to provide the economy with organic growth, helping create more fiscal provisions to reduce the burden of the debt in the country.”

Citiesabc was created by a team of global industry leaders, academics and experts to create new solutions, resources, rankings and connections for the world’s top cities and populations.